Equity Research Report: Micron Technology (MU)

A Pure-Play Beneficiary of the AI-Driven Memory Supercycle

Recommendation: Buy

Analyst’s Note: This report is a follow-on analysis to our initial investment in Micron, initiated on August 8, 2025, at an entry price of $118.63. Given the significant market developments and stock appreciation since that time, this deep-dive re-evaluates the fundamental and strategic landscape to assess the thesis for adding to the position at current levels.

1. Fundamental Analysis: Firing on All Cylinders

Micron Technology’s recent financial performance and forward-looking guidance signal a profound operational inflection point, transitioning the company from a participant in a cyclical recovery to a leader in a structural, AI-driven growth phase. The analysis of its latest earnings, financial trajectory, valuation, and ownership structure reveals a company with accelerating momentum whose long-term earnings power is not yet fully reflected in its public market valuation.

1.1. Earnings Debrief: A Breakout Quarter Signaling an Inflection Point

Micron concluded its fiscal year 2025 with an exceptionally strong fourth quarter, delivering results that surpassed both elevated analyst expectations and the company’s own recently upgraded guidance.1 This performance serves as a powerful confirmation that the company is capitalizing on the robust demand environment for high-performance memory.

Revenue: The company posted record Q4 revenue of $11.32 billion, comfortably exceeding the consensus forecast of $11.11 billion. This figure represents a remarkable 46% year-over-year (YoY) and a 22% quarter-over-quarter (QoQ) increase, illustrating a steepening growth curve.1

Earnings Per Share (EPS): Non-GAAP EPS came in at $3.03, significantly outperforming the consensus estimate of $2.77, which constitutes a 9.4% positive surprise.1 This result marks the ninth consecutive quarter in which Micron has beaten earnings forecasts, establishing a consistent track record of under-promising and over-delivering.7

Forward Guidance: Perhaps the most compelling element of the report was the robust guidance for the first quarter of fiscal 2026. Management projects revenue to reach $12.50 billion (±$300 million) and non-GAAP gross margin to be 51.5% (±1.0%).5 This outlook implies a sequential revenue acceleration of $1.2 billion and a formidable gross margin expansion of approximately 580 basis points, signaling that the current momentum is not only sustainable but intensifying.4

1.2. Financial Trajectory: Unpacking Revenue Growth and Structural Margin Expansion

A deeper examination of Micron’s financial statements reveals a company undergoing a fundamental transformation in its revenue mix and profitability profile. The growth is not merely cyclical; it is being driven by a structural shift toward higher-value, higher-margin products that are essential for the artificial intelligence ecosystem.

Revenue Analysis: For the full fiscal year 2025, revenue soared to a record $37.4 billion, a nearly 50% increase from the prior year. This growth was propelled by a combination of favorable pricing dynamics and, more importantly, exceptional performance in the data center end market.1 The Cloud Memory Business Unit (CMBU) was the primary engine of this growth, generating $4.5 billion in Q4, which accounted for 40% of the company’s total revenue. This segment operated at an extraordinary 59% gross margin, underscoring the lucrative nature of AI-related memory demand.3

Margin Trends: The company’s profitability is on a steep upward trajectory. Non-GAAP gross margin expanded to 45.7% in Q4, a significant increase from 39.0% in Q3 and 36.5% in the same quarter of the previous year.4 For the full fiscal year, gross margins widened by an impressive 17 percentage points to 41%.1 The guidance for Q1 FY26 margins to cross the 50% threshold is a landmark event. This is not just a cyclical peak but evidence of a structural enhancement of the company’s earnings power, driven by the increasing weight of premium products like High-Bandwidth Memory (HBM) and DDR5 in the sales mix.4

Cash Flow Dynamics: Micron demonstrated strong cash generation capabilities despite its aggressive investment cycle. Cash flow from operations was a robust $5.7 billion in Q4 (representing 51% of revenue) and totaled $17.5 billion for the full fiscal year.3 Even after funding substantial net capital expenditures of $4.9 billion for the quarter, the company generated a positive adjusted free cash flow (FCF) of $803 million. For the full year, adjusted FCF was $3.7 billion.3 This ability to self-fund its capacity expansion for next-generation technologies while generating positive FCF is a testament to the powerful operating leverage in the business model.

Note: Historical data synthesized from multiple earnings reports. Forecasts for FQ1-25 to FQ3-25 are illustrative based on analyst consensus trends leading up to the FQ4 report. FQ4-25 and FQ1-26 figures are based on the latest report and guidance.

1.3. Valuation Analysis: Re-rating Potential in a New Paradigm

Despite the stock’s strong performance, Micron’s valuation metrics, particularly on a forward-looking basis, suggest that the market has not yet fully priced in its transformation from a cyclical commodity producer to a structural growth company at the heart of the AI revolution. A significant opportunity for a valuation re-rating exists as the durability of its earnings power becomes more widely recognized.

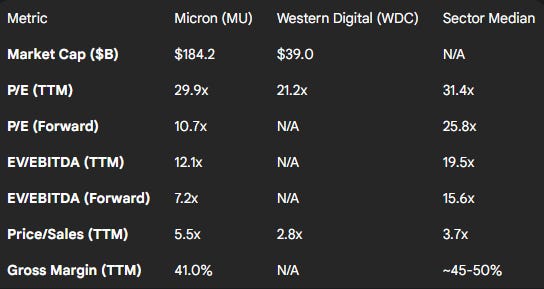

Forward Price-to-Earnings (P/E): Micron trades at a compelling forward P/E ratio of approximately 10.7x.9 This represents a steep ~58% discount to the semiconductor sector median of 25.8x. This valuation is more characteristic of a company in a cyclical trough than one at the beginning of a multi-year, AI-fueled supercycle.

Enterprise Value to EBITDA (EV/EBITDA): The undervaluation thesis is further supported by the forward EV/EBITDA ratio of just 7.2x. This metric, which accounts for the company’s debt, trades at a ~54% discount to the sector median of 15.6x.9

Peer Comparison: On a trailing twelve-month (TTM) basis, Micron’s P/E ratio of approximately 29-30x appears reasonable when compared against the US Semiconductor industry average of ~35x and the broader peer group average.8 While direct valuation comparisons with its primary competitors, Samsung and SK Hynix, are complicated by their status as foreign-listed conglomerates (which often leads to a “Korea discount”), Micron’s status as a pure-play memory company offers investors the most direct and undiluted exposure to the memory upcycle, which should arguably command a premium valuation.

1.4. Ownership Structure: Interpreting Insider Sales Amidst Institutional Confidence

Analysis of Micron’s ownership reveals a notable divergence between the trading patterns of corporate insiders and large institutional investors. While insider sales have been frequent, the conviction displayed by major investment funds provides a more powerful and forward-looking signal.

Insider Activity: Public filings show a consistent pattern of selling by Micron’s executives and directors over the past year, with a complete absence of open-market buys.4 CEO Sanjay Mehrotra, in particular, has been a regular seller through transactions often designated as “Automatic Sells”.20

Institutional Holdings: In sharp contrast, institutional ownership of Micron is exceptionally high, standing at approximately 95% of outstanding shares.22 More importantly, recent filings show significant accumulation by some of the world’s most sophisticated investors. In the most recent quarter, Capital World Investors increased its position by over 16.5 million shares (a 30.4% increase), and D. E. Shaw & Co. made a massive addition of over 7.1 million shares (a 4,427% increase).4

Reconciliation: This apparent contradiction can be reconciled by understanding the differing motivations behind these transactions. The insider sales are overwhelmingly part of pre-arranged 10b5-1 trading plans. Such plans are standard practice for corporate executives to systematically liquidate a portion of their equity-based compensation for personal financial planning, tax obligations, and diversification. They are not typically indicative of a change in the executive’s outlook on the company’s future. Conversely, the multi-billion dollar investment decisions made by institutions like Capital World are based on exhaustive, forward-looking fundamental analysis. Their substantial net buying activity represents a clear and strong vote of confidence in Micron’s growth trajectory and undervaluation. The signal from this “smart money” should be weighted far more heavily than the noise from routine insider liquidations.

2. Thesis Validation: Bullish on HBM Dominance

The investment thesis for Micron is anchored in its strategic transformation from a supplier of cyclical commodity memory chips to a structural growth company providing indispensable technology for the multi-year artificial intelligence infrastructure buildout. This thesis is supported by Micron’s dominant position in the high-value HBM market, its structurally improved profitability profile, and a favorable supply-demand landscape that confers significant pricing power.

2.1. The Bull Case: Three Pillars of Growth

Argument 1: Unassailable Position at the Epicenter of the AI Infrastructure Buildout

Micron is no longer a peripheral component supplier; it is a direct and critical enabler of the AI revolution. The company’s most advanced products are foundational to the performance of the AI data center.

HBM as the Linchpin: The company’s High-Bandwidth Memory (HBM) is essential for the high-throughput, parallel processing required for training and inference workloads in GPUs and other AI accelerators.24 The demand for this technology is exploding. Micron’s management has raised its forecast for the HBM Total Addressable Market (TAM) to exceed $30 billion in calendar 2025, growing to a staggering $100 billion by 2030.19

Key Customer Validation: Micron has solidified its strategic importance by securing design wins with the undisputed leaders in AI hardware. It is the sole supplier of LPDRAM for NVIDIA’s GB-product family and its industry-leading HBM3E is integrated into both NVIDIA’s H200 and GH200 accelerators and AMD’s Instinct MI350X platform.2 These partnerships are not just sales agreements; they are deep engineering collaborations that validate Micron’s technology roadmap.

Exceptional Visibility: The demand is so intense that Micron’s entire HBM supply is sold out through calendar 2025 and well into 2026.27 This provides an extraordinary level of revenue and margin visibility, significantly de-risking near-term forecasts. In the most recent quarter, HBM revenue reached an annualized run rate of nearly $8 billion, demonstrating the scale of this business line.2

Argument 2: Sustainable Profitability Driven by a High-Value Product Mix Shift

The company’s rapid margin expansion is not a temporary phenomenon driven by pricing alone; it is the result of a deliberate and successful strategic shift toward a richer, more profitable product portfolio.

The Power of Mix: The move towards HBM, high-capacity server DIMMs, and data center SSDs is fundamentally altering the company’s financial structure. In fiscal 2025, the combined revenue from these high-value data center products surged to $10 billion, a five-fold increase year-over-year.2

Data Center as the Profit Engine: The data center segment (encompassing CMBU and CDBU) now constitutes a record 56% of Micron’s total revenue and operates at a blended gross margin of 52%—significantly accretive to the corporate average.2 As this segment is poised to continue growing faster than the consumer-facing parts of the business, it will act as a powerful, ongoing tailwind for blended corporate margins.

Technological Leadership: This favorable mix is underpinned by technological leadership. Micron was the first in the industry to ship 1-gamma DRAM, its most advanced process node, which enables superior product specifications, lower power consumption, and faster time-to-market.1 This leadership allows Micron to qualify its products for the most demanding applications and command the premium pricing associated with them.

Argument 3: Enduring Pricing Power from Favorable Supply-Demand Imbalance

The memory market has entered a period of sustained supply tightness, which grants Micron and its peers significant pricing power. This dynamic is driven by both surging demand and structural constraints on the supply side.

Strong Pricing Environment: Market analysts and industry participants expect DRAM and NAND average selling prices (ASPs) to continue their upward trend through 2025 and potentially into 2026.19 This provides a powerful tailwind for revenue and margin growth.

Structural Supply Constraints: The supply tightness is not merely a temporary imbalance. The industry’s shift to producing HBM structurally reduces the available supply of standard DRAM. HBM manufacturing is more complex and requires significantly more clean room space and processing steps (such as Through-Silicon Vias, or TSVs) than conventional DRAM.33 As Micron, Samsung, and SK Hynix all dedicate more of their finite fab capacity to the high-margin HBM market, they are inherently “cannibalizing” their ability to produce standard DRAM, thus tightening supply for the entire market and supporting prices across the board.25

Disciplined Capital Expenditure: The industry is demonstrating capital discipline. Micron’s own forecast for a 45% increase in memory capex in 2025 is primarily directed at technology transitions and HBM capacity, not simply adding raw wafer capacity for commodity products.25 This focused investment strategy helps prevent the oversupply that has plagued previous cycles.

2.2. Key Risks and Counter-Arguments

While the bull case is compelling, a comprehensive analysis must acknowledge potential risks that could challenge the investment thesis.

Risk 1: Competitive Pressure from Larger, Diversified Peers

Micron operates in an oligopoly and faces intense competition from formidable rivals, primarily Samsung Electronics and SK Hynix. Both competitors are larger, have greater financial resources, and operate more diversified business models.24 There is a tangible risk that these competitors could accelerate their own HBM production ramps more aggressively than anticipated. Reports suggest Samsung, in particular, is determined to regain market share it has lost in the HBM segment.10 A significant increase in competitive supply could lead to pricing pressure and erode the margin expansion story that is central to the bull thesis.36Risk 2: Macroeconomic Sensitivity and Inherent Industry Cyclicality

The semiconductor industry has a long history of boom-and-bust cycles, having experienced nine downturns in the past 34 years.38 A severe global economic recession could lead to a pullback in enterprise IT spending and slow the pace of the AI infrastructure buildout, impacting demand. Furthermore, while the data center segment is currently booming, consumer-facing markets such as PCs and smartphones remain relatively soft, which could continue to be a headwind for Micron’s NAND business.39 Finally, geopolitical risks, especially escalating trade tensions between the U.S. and China, could disrupt the highly globalized semiconductor supply chain, impacting material costs, manufacturing logistics, and market access.39

2.3. Final Verdict: Bullish

The final verdict remains Bullish. The evidence strongly suggests that the powerful, secular tailwinds from the AI infrastructure supercycle are more than sufficient to outweigh the cyclical and competitive risks. Micron’s validated technological leadership, its deep integration with key AI platform leaders, and the structural supply constraints shaping the memory market create a multi-year runway for exceptional growth in revenue and profitability. The current market valuation fails to adequately capture the magnitude of this fundamental transformation, presenting a compelling investment opportunity.

3. Sector & Macroeconomic Context: A Market Reshaped by AI

Micron’s corporate strategy and financial performance are unfolding within a uniquely favorable industry and macroeconomic environment. The semiconductor memory market is in the midst of a powerful upcycle, driven by the transformative demands of artificial intelligence. This is further amplified by supportive government policies aimed at re-shoring critical manufacturing, which provides a strategic tailwind for Micron as the leading U.S.-based memory producer.

3.1. Semiconductor Memory Market Outlook (2025-2026)

The broader semiconductor market is experiencing robust growth, with projections indicating it will reach nearly $700 billion in 2025 and continue on a trajectory to become a $1 trillion industry by 2030. The memory segment is at the vanguard of this expansion.

Explosive Segment Growth: Market research firm TrendForce projects that DRAM industry revenue will surge by 51% in 2025 to reach $136.5 billion, while NAND Flash revenue is expected to grow by 29% to $87 billion.32 This level of growth far outpaces that of the general economy and most other industrial sectors.

AI as the Primary Catalyst: The single most important driver for this growth is artificial intelligence. AI has displaced traditional drivers like automotive and wireless communications as the top application for semiconductors.24 The immense computational requirements of AI models, both for training in large data centers and for inference at the network edge (in AI-enabled PCs and smartphones), demand an exponential increase in the amount of high-speed, high-capacity memory, directly benefiting Micron.24

Favorable Pricing Environment: The market is characterized by a supply-demand imbalance that is forecast to persist through 2025 and into 2026. This dynamic is expected to lead to sustained and significant price increases for both DRAM and NAND products. Recent industry reports indicate that major producers like Samsung have signaled their intent to implement dramatic price hikes of up to 30% for DRAM in the fourth quarter of calendar 2025, confirming the strong pricing power held by suppliers.30 The historical boom-bust nature of the memory market is being fundamentally altered by this persistent, structural demand from AI, making the current upcycle more durable than those of the past.

3.2. Macro Forces: Navigating Geopolitical Tailwinds and Headwinds

The global macroeconomic landscape presents a complex mix of opportunities and challenges for Micron. While geopolitical tensions create risks, the strategic response from governments, particularly in the United States, has created a powerful long-term tailwind.

Tailwind: Government Support and Onshoring (CHIPS Act): Micron is a prime beneficiary of a global strategic shift toward supply chain resilience. The U.S. CHIPS and Science Act is a landmark piece of industrial policy designed to bring advanced semiconductor manufacturing back to American soil. Micron has already received CHIPS Act grant disbursements for its new high-volume manufacturing fab in Idaho and has announced a long-term plan to invest approximately $200 billion in U.S.-based manufacturing and R&D over the next two decades.2 This government support not only provides direct financial benefits but also significantly de-risks Micron’s long-term supply chain from geopolitical disruptions.

Headwind: Geopolitical Tensions and Territorialism: The strategic competition between the United States and China remains a significant source of uncertainty for the semiconductor industry. The imposition of tariffs, export controls, and other trade restrictions could disrupt the intricate global supply chain, increase the cost of raw materials and equipment, and impact access to key markets.39 Industry executives consistently rank this form of “territorialism” as one of the most significant risks they face.42

Other Macro Factors: The broader economic environment also plays a role. Persistently elevated interest rates could dampen consumer spending on electronics, potentially impacting the more consumer-exposed segments of the market.41 Conversely, a growing global focus on sustainability and energy efficiency plays to Micron’s strengths. The immense energy consumption of AI data centers is creating strong demand for more power-efficient components, an area where Micron’s low-power HBM and next-generation DRAM products offer a distinct advantage.27

3.3. Competitive Positioning: Micron’s Differentiated “Pure-Play” Advantage

The global memory market is a highly concentrated oligopoly, with three companies—Samsung, SK Hynix, and Micron—controlling the vast majority of both DRAM and NAND production.24 Within this structure, Micron has carved out a unique and increasingly advantageous competitive position.

Technological Leadership: While Micron is the smallest of the “big three,” it has consistently demonstrated technological leadership in critical areas. It was the first company in the world to begin volume shipments of 1-gamma DRAM, its most advanced manufacturing process, and its HBM3E products are recognized for their industry-leading power efficiency.1 This technological prowess allows it to compete effectively for the most demanding and profitable market segments.

The “Pure-Play” Advantage: In previous industry cycles, Micron’s status as a pure-play memory company was often seen as a liability, making it highly vulnerable to market downturns. In the current AI-driven cycle, however, this focus has become a significant strength. Unlike Samsung, which must balance its capital allocation between memory, its foundry business, and its vast consumer electronics empire, Micron can direct 100% of its R&D and capital expenditure toward extending its lead in memory and storage technologies.14 This focused execution provides investors with the most direct, undiluted exposure to the powerful secular trends in the memory market. This clarity and focus should, over time, command a valuation premium relative to its more complex and diversified competitors.

4. Catalyst Watch: Mapping the Path Forward

A series of well-defined short- and long-term catalysts are poised to unlock further value in Micron’s stock, providing tangible milestones that will validate the investment thesis and likely drive a re-rating of its valuation. Many of these catalysts are de-risked by the exceptional visibility the company currently enjoys in its key growth markets.

4.1. Short-Term Catalysts (6-12 Months)

Continued Earnings Beats & Guidance Raises: The most immediate catalysts will be the company’s own financial reports. Given the powerful momentum demonstrated in the Q4 results and the exceptionally strong Q1 2026 guidance, there is a high probability that Micron will continue to exceed consensus estimates in the upcoming quarters (FQ1-FQ3 2026). This is supported by the ongoing ramp of its sold-out HBM products and the favorable pricing environment.7

DRAM/NAND Contract Price Announcements: The outcomes of quarterly contract price negotiations serve as a real-time barometer of market health. Public reports and industry checks confirming further sequential price increases for DRAM and NAND will provide tangible evidence of the ongoing supply tightness and the robust pricing power held by Micron and its peers.26

HBM4 Customer Qualification Updates: Micron has already begun shipping customer samples of its next-generation HBM4 memory.2 Any positive public announcements regarding the successful qualification of this technology with key partners like NVIDIA and AMD would serve to validate Micron’s forward-looking technology roadmap and reinforce its position as a leader in high-performance memory.29

Market Share Reports: Independent, third-party market share reports from research firms like TrendForce will be closely watched. Data showing that Micron is gaining or maintaining share in high-value segments, such as HBM and data center SSDs, would provide external validation of its strong execution and competitive positioning.2

4.2. Long-Term Catalysts (12-36 Months)

Execution of Technology Roadmap:

HBM4 Volume Ramp (Calendar 2026): The successful ramp to high-volume manufacturing of HBM4 will be a critical long-term catalyst. This next-generation product promises over 60% higher performance than the current HBM3E, and its timely delivery will be essential for maintaining leadership in the AI accelerator market.28

1-gamma DRAM Proliferation: The successful transition of its broader DRAM portfolio to the leading-edge 1-gamma manufacturing node will drive significant, long-term benefits in cost, power efficiency, and performance, widening the company’s competitive moat.1

G9 NAND Adoption: The successful market adoption of its new G9 QLC NAND-based SSDs, which feature innovative Adaptive Write Technology, could significantly expand Micron’s addressable market in the client and consumer SSD segments by offering TLC-like performance at a more competitive cost.2

U.S. Manufacturing Expansion Milestones:

Idaho Fab (ID1) First Wafer Out (Second Half of Calendar 2027): A pivotal moment for the company and the U.S. semiconductor industry will be the first wafer output from its new fab in Boise, Idaho. This will mark the return of leading-edge DRAM manufacturing to the United States and will be the first tangible result of its massive CHIPS Act-supported expansion plan.2

New York Fab Construction Updates: Progress reports on the development of its planned mega-fab complex in Clay, New York—from groundbreaking to major construction milestones—will provide investors with visibility into Micron’s long-term capacity growth and its strategy of geographic diversification.29

Enhanced Capital Return Program: As the company’s free cash flow generation accelerates significantly through fiscal 2026 and beyond, there is a strong potential for the board to authorize an enhanced capital return program. While share buybacks are currently suspended, their reinstatement, along with potential dividend increases, could attract a new class of income-oriented and value investors to the stock.3

The path to realizing these catalysts is clearer and less speculative than for many technology companies. A significant portion of Micron’s premium revenue for the next 12-15 months is already secured through its sold-out HBM capacity.28 The industry-wide supply constraints are rooted in the physical limitations of fab construction and technology transitions, providing high confidence in the pricing outlook. This high degree of visibility increases the probability of positive catalyst realization in the near to medium term.

5. Investment Summary

This analysis concludes that Micron Technology represents a compelling investment opportunity, driven by a fundamental transformation of its business and a highly favorable industry backdrop. The company is uniquely positioned to capitalize on the multi-year, secular growth in demand for high-performance memory fueled by the artificial intelligence revolution.

5.1. Five-Point Investment Thesis Summary

AI Supercycle Beneficiary: Micron is a direct and indispensable supplier of critical high-performance memory (HBM) and storage solutions for the ongoing AI infrastructure buildout. Its leadership is validated by deep partnerships with key AI platform companies, and its HBM supply is sold out through calendar 2025, providing exceptional revenue visibility.

Structural Margin Expansion: A strategic and successful shift toward high-value data center products has fundamentally lifted the company’s profitability profile. With gross margins guided to exceed 50%, Micron is breaking free from its historical identity as a low-margin, cyclical commodity producer.

Favorable Industry Dynamics: The memory market is experiencing a period of sustained supply tightness, driven by disciplined industry-wide capital expenditure and the cannibalization of standard DRAM capacity for HBM production. This creates a durable tailwind for strong pricing power across Micron’s entire product portfolio.

Compelling Undervaluation: Despite its strong performance, the stock trades at a significant discount to the broader semiconductor sector on key forward-looking valuation multiples, including P/E and EV/EBITDA. The current valuation fails to adequately reflect the company’s transformation into a structural AI growth story, presenting a clear opportunity for a re-rating.

Technological and Geopolitical Moat: Micron’s leadership in next-generation process nodes (1-gamma DRAM) provides a tangible technological advantage. Furthermore, its position as the primary U.S.-based memory champion, strongly supported by the CHIPS and Science Act, creates a long-term, strategic geopolitical advantage over its Asia-based competitors.

This analysis was powered by the ARMR Method™. To get my real-time insights, full portfolio access, and join a community of serious investors, explore our premium services

DISCLAIMER: All of ARMR Report, our trades, strategies, and news coverage are based on our opinions alone and are only for entertainment purposes. You should not take any of this information as guidance for buying or selling any type of investment or security. I am only sharing my biased opinion based off of speculation and personal experience. An individual trader’s/investor’s results may not be typical and may vary from person to person. It is important to keep in mind that there are risks associated with investing in the stock market and that one can lose all of their investment. Thus, trades/investments should not be based on the opinions of others but by your own research and due diligence.